Critical reflections on strategic decision making and the application process

Critical Reflections On Strategic Decision Making And The Application Process

1. Question

2. Description

3.Reflections on strategic decision making and the application process

You are required to reflect on by analysing and then synthesising (i.e., drawing together the evidence or facts into a coherent argument) what you have learned about strategic management and the decision-making process in this subject. Your responses may relate to:

• steps in the learning process and how you applied these. (i.e. the methods used)

• new learning and knowledge gained from experiences or events in studying this subject.

• the results or consequences of applying new learning and knowledge as the subject progressed.

• how new learning and knowledge was, or could have been, developed and reinforced.

Stuck with a lot of homework assignments and feeling stressed ?

Take professional academic assistance & Get 100% Plagiarism free papers

Questions:

Explain what you have learned about strategic management by studying this subject, and critically reflect on the application of strategic management concepts by your company or a company you are familiar with.

1. What learning has been relevant and what has not?

2. How can your learning be applied in your company?

3. What outcomes should be changed or delivered in your company?

4. Why are these outcomes important?

5. What things should be done differently in your company and why?

Note:- There are many other resources available on the internet and data bases that may assist you with this assessment please draw upon these resources when constructing the responses to the questions.

Strategic management:

Strategic management involves the higher management and decision makers by formulation and implementation of company goals. The main issues of strategic management are internal and external environment analysis of any company (Hill et al. 2012). It provides the basic direction of plans, objectives and company policy for any particular organization. The optimal allocation of resources and implementation of the plans are the main fundamentals of strategic management. It depends on strategic planning and strategic thinking.

Strategic management process:

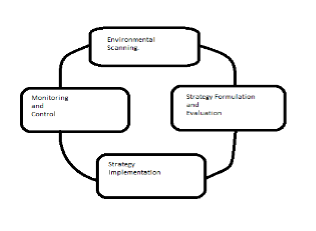

The management process has four phases as mentioned below:- First phase is environmental analysis, which is internal and external environmental analysis which is done by the analysis of the strength, weakness, opportunity and threats of any particular company. Second phase is strategy formulation and evaluation, which is the work of higher authority and managements. In this phase the objectives and goals are created. Third phase is strategy implementation; which implement the taken strategy and describes the process of achieving goals.

The last phase is monitoring and control. Microsoft is a well-known company for all audience. Bill Gates and some of his friends made the Microsoft in 1980. It was a giant IT organization. They invented WINDOWS operating system in mid of 1980. In 1993 they invented a newer version of UNIX operating system. 2005 was the year of purchasing for Microsoft. They purchased Foldershare, Groove Network, Sybari software and FrontBridge technology.

Buy high-quality essays & assignment writing as per particular university, high school or college by UK, USA & Australian Writers

1. What learning has been relevant and what has not?

In strategic management framework, there are various concepts and theories.

a. SWOT analysis:- It was coined by Harvard Business School in 1960. Basically it states the internal and external environment of organization through the strength, weakness, opportunity and threats. SWOT is a comprehensive analysis between company competence and environment.

b. Experience Curve:-Boston Consulting Group invented this in 1966. This states that whenever the cumulative production doubles, the unit cost will decline by about 15-25%. It helps in improving cost structure, competitive advantage, gaining higher market share and empirical analysis (Slywotzky et al. 1999).

c. Portfolio analysis:- The main anthem of this theory is diversification through acquisition (Anslinger and Copeland, 1999). This is based on Growth share matrix which was developed by Boston Consulting Group in 1970.

d. Five forces analysis:- This was coined by Mr. Porter in 1980. It is very helpful in analyzing the profitability and the distribution of profits in participants.

Microsoft had acquired Fast search and Transfer in 2008 and in the same year they started working with HP and Motorola. They know how to manage the business strategy and how to implement the strategic management in all fields. Strategic management helps to provide a higher profitability rate for every organization (Goold and Luchs, 1993).

2. How can your learning be applied in your company?

Learning helped in the process of environmental scanning by gauging the strength and weakness (internal analysis) and opportunity and threats (external analysis) of a particular organization. BCG matrix can provide the present scenario in terms of market growth and share. PLC curve can present the life cycle curve of a product. Porters five forces model can state the competitive advantage and customers bargaining power of a particular product. Portfolio analysis can help in company diversification and future growth (Koudsi, 2001).

Microsoft had a great platform on operating system, mobile phone software and related accessory programs without having ample presence in the hardware domain. For the future diversification of the company they merged with NOKIA to regain its market share in the software field as well as create its brand image in the hardware sector.. They have launched NOKIA X series in early 2014 which attracted many tech savvy people. So applying a good strategic management theory in any organization creates something good for that organization itself (Pare, 1994).

3. What outcomes should be changed or delivered in your company?

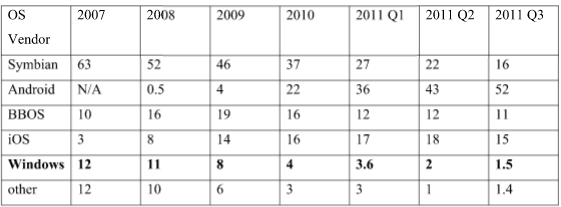

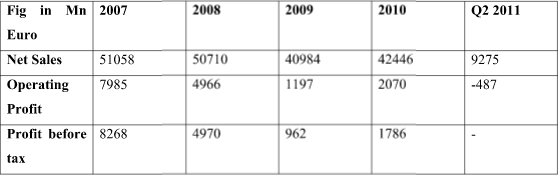

Microsoft started losing their business since 2007. The below table shows the difference in business for Microsoft:

When popular product or service is falling then this is the time for change or for diversification (Davis, 2009). At that period of time NOKIA was also losing their sales for Windows based mobile software. The sales rate of NOKIA is following:

Microsoft went for SWOT analysis and came with diversification strategy. Developing nations and emerging economies like India, China has high demand of android technology.

A.The demand was increasing for high-end mobile phone (business phone or smart phones).

B. New software developing rate was maximum.

Flexible Rates Compatible With Everyone’s Budget

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

4. Why are these outcomes important?

In one hand Microsoft was losing their business regarding to mobile phone software and operating system. And On the other hand NOKIA was losing their market share. For the above outcomes Microsoft decided to merge with NOKIA. These outcomes were very important for both the merging companies. After merging Microsoft and NOKIA produced X series; which have created a good customer feedback so far.

5. What things should be done differently in your company and why?

To be a market leader a company should have the ability to adapt or else it will perish in the long run (Parker, 2009). Taking cue from this judgment Microsoft too opted for the diversification as per the strategic management plan which helped itself immensely to cut down the losses, regain its reputation as one of the best market players in the industry with the aim and determination to move for a holistic growth and development of the company keeping the relational, integrated, personal and socio-economic factors in mind. So, the health of a company depends on its effective decision making and astute strategic management and planning.

References:

Anslinger, P. A. and Copeland, T. E. (1996). Strategic Decision Making: Growth through acquisition: A fresh look. Harvard Business Review, 74 (1):126–35.

Davis, Y., (2009). Business Today. 8 th edition. Abeceda Antiquariat Inh. C. Grossel: Germany.

Goold, M. and Luchs, K. (1993). Why diversify? Four decades of management thinking. Strategic Decision Making. Academy of Management Executive, 7(3):7–25.

Hill, Charles W.L., Gareth R. J. (2012). Strategic Management Theory: An Integrated Approach, Cengage Learning, 10th edition

Koudsi, S. (2001). Remedies for an economic hangover. Fortune, June 25:130–39. Pare, T. P. (1994). The new merger boom. Fortune, November 28:96.

Parker, T., (2009). Management Control Systems. Johns Hopkins University Press: Malaysia

Slywotzky, A., Morrison, D., Moser, T., Mundt, K., and Quella, J. (1999). Profit Patterns, Time Business (Random House), New York